Once you’ve calculated your expected company startup costs, add 20% to this amount to account for unanticipated expenses. This buffer can mean the difference between staying afloat and struggling to maintain operations during unexpected challenges.

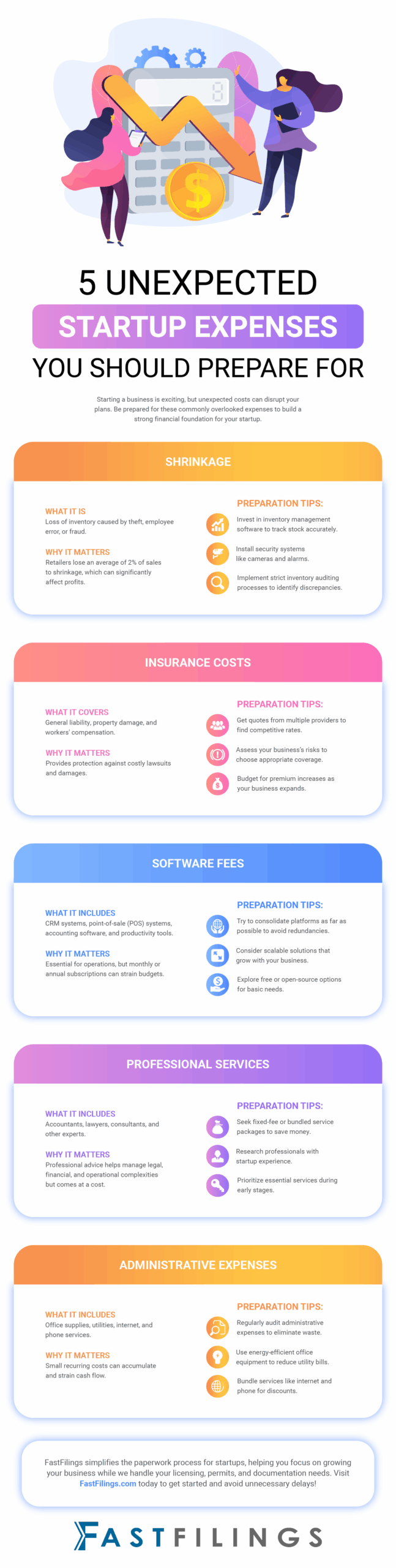

Even with careful planning, though, there are certain startup expenses that tend to catch new business owners off guard. These include shrinkage, insurance costs, software fees, professional service expenses, and administrative expenses. Recognizing and making plans for these potential pitfalls is key to preparing an effective financial plan and avoiding costly surprises.

Want to learn more about how to start a business while staying financially secure? Below, we explore these five unexpected company startup expenses in detail, offering insights to help you plan better. For additional support with opening a business, such as obtaining seller’s permits, managing annual reports, or navigating other filing requirements, check out FastFilings’ online services. We’re here to help simplify the paperwork so you can focus on growing your business.