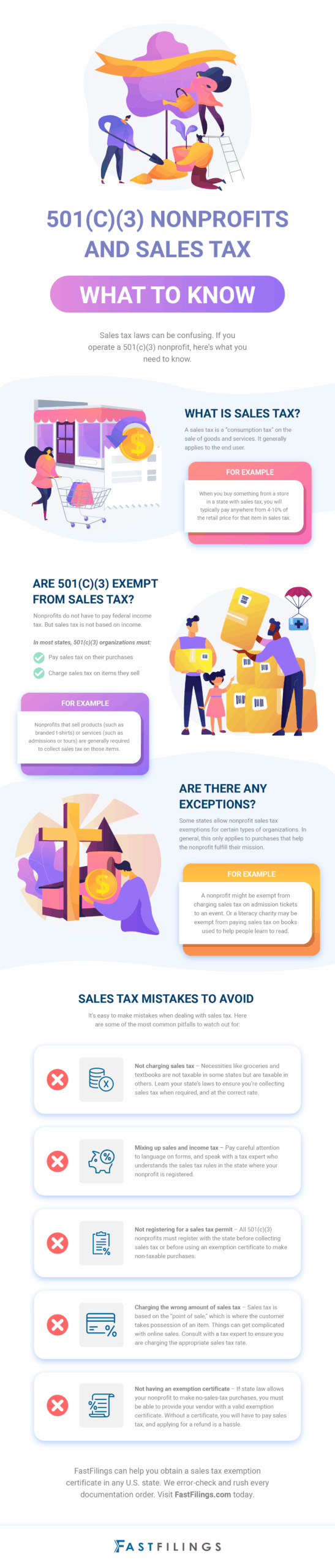

Are 501(c)(3) Exempt from Sales Tax?

Given the charitable nature of their work, the Internal Revenue Service (IRS) exempts nonprofits from paying federal income tax. Most states also apply this exemption to state income tax.

Sales tax is more complicated. That’s because sales tax is managed at the state level, and states do not automatically apply an exemption for nonprofits.

Forty-six states (plus Washington DC) have sales tax, and each one makes its own rules and laws around how nonprofits are required to pay and charge sales tax.

Keep reading to find out how sales tax applies to 501(c)(3) nonprofits and how to get a nonprofit sales tax exemption certificate.

Get Your Sales Tax Exemption Certificate with FastFilings

The experts at FastFilings can help you obtain a sales tax exemption certificate in any U.S. state. We error-check and rush every documentation order we file on your behalf. Explore FastFilings to learn more about getting a sales tax exemption certificate for your 501(c)(3) nonprofit.