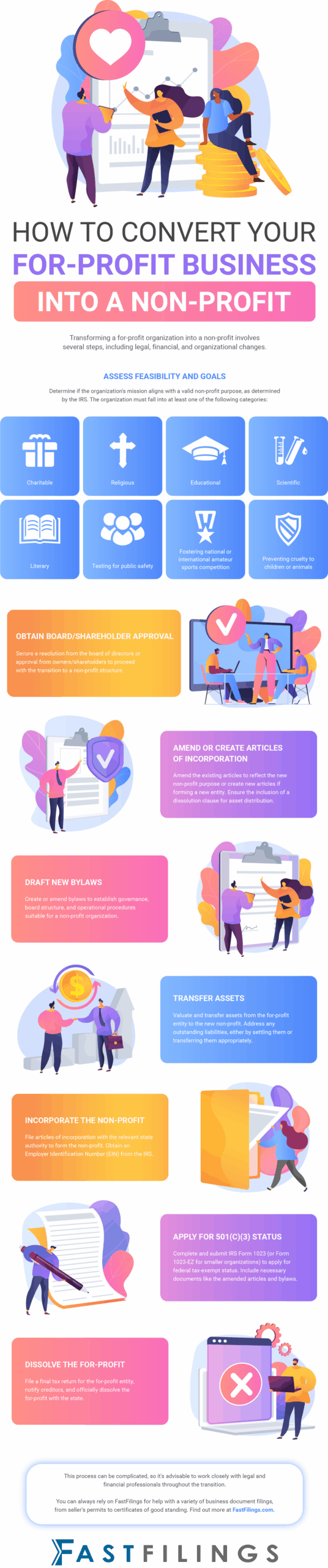

Not sure how to convert an LLC to non-profit status? Or how about going from a S-Corporation to a non-profit? FastFilings is here to help.

It’s important to note that converting a for-profit company into a non-profit typically requires re-incorporation as a non-profit entity, as state laws often do not allow a direct conversion. This process involves creating new bylaws, transferring assets, and obtaining federal tax-exempt status. You should always check state laws for specific guidance.