Choosing the right business entity is a big decision to make. There are many factors to consider in determining which type of business best meets your needs.

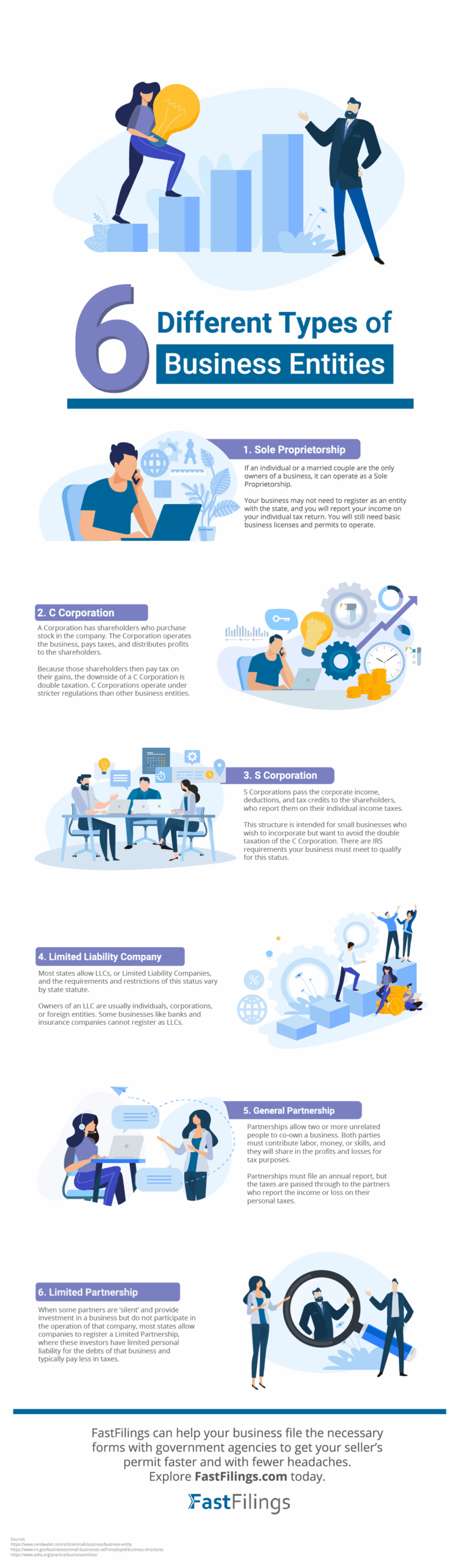

For example, if you’re an individual or a married couple that wants to be the sole owner of your business, you may want to consider a sole proprietorship.

Or if you’re looking to share ownership of your company with stakeholders, a C or S corporation may be ideal. C Corporations have stakeholders that purchase stock in the company. They also pay taxes and distribute profits to shareholders.

On the other hand, S Corporations pass corporate income deductions and tax credits to their shareholders. This type of corporation is ideal for small businesses who want to incorporate but don’t want to deal with double taxation.

A Limited Liability Company can be owned by individuals, corporations, and even foreign entities. However, some businesses, such as insurance companies and banks, cannot register as LLCs.

Last, we have two types of partnerships: general and limited. A general partnership allows two or more unrelated people to own a business together. Both parties must contribute money, labor, and skills. Profits and losses are shared.

A limited partnership involves silent partners who provide investment but don’t participate in the operation of the company.

Once you identify which type of business entity best meets your needs, the next step is to use FastFilings! We help businesses of all types file the required government forms that are needed to obtain your seller’s permit. Explore our website and services today!